Weekly Market Index

Last week’s crypto market price index dropped by -3.01%. Volume and volatility indices showed a slight increase by +0.44% and +0.05%, respectively.

Bitcoin’s (BTC) price fluctuated between US$65,000 and US$70,000 through the week and settled at close to US$70,000 on 7 April 2024. US Spot Bitcoin ETFs had a week of net inflows totalling US$485 million, lower than the US$845 million net inflow in the previous week. Grayscale Bitcoin Trust ETF’s (GBTC) weekly net outflow slowed down to US$738 million last week (vs US$967 million the week prior).

Notes: Based on market-cap adjusted index of selected top-cap tokens

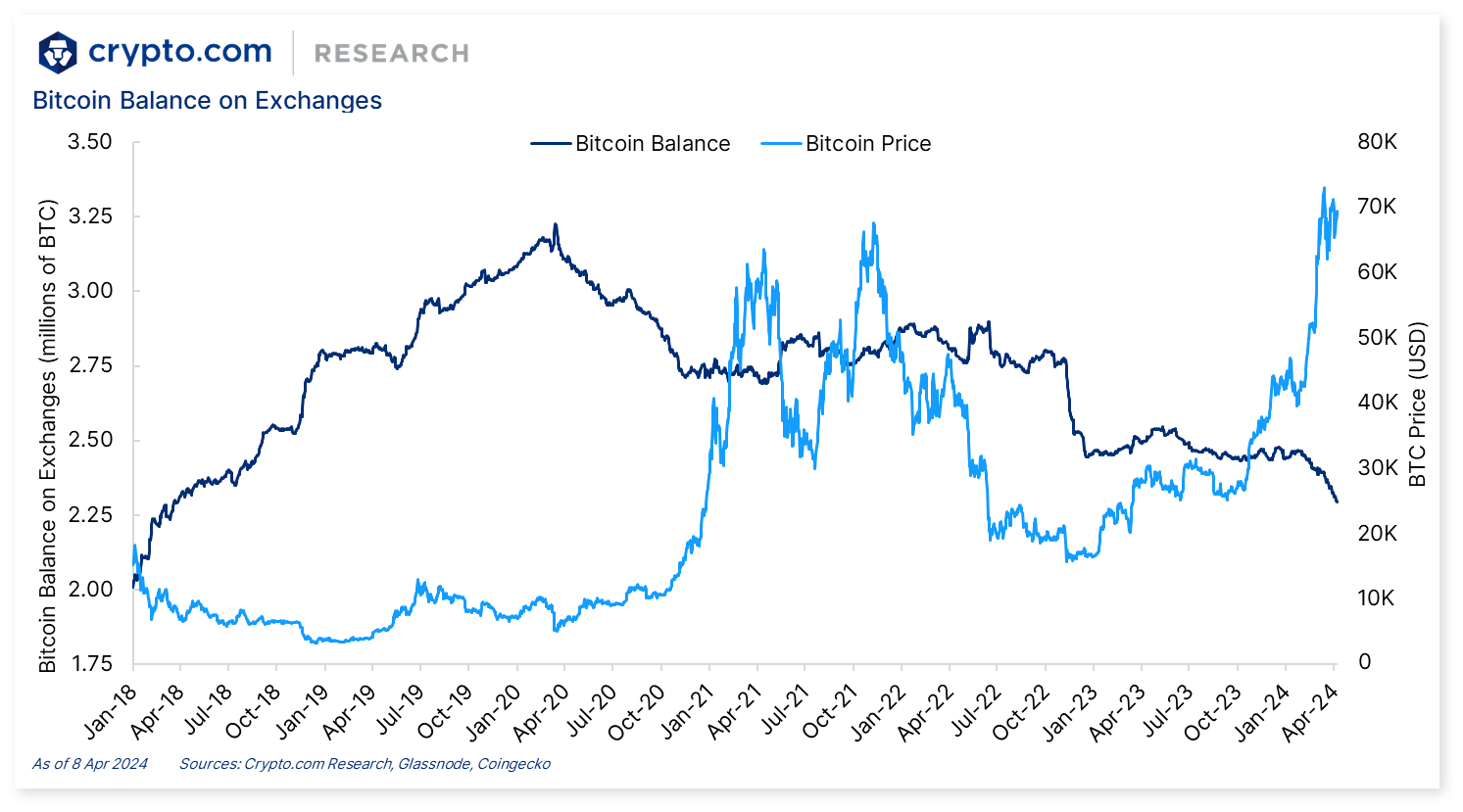

Chart of the Week

As of 7 April 2024, approximately 2.3 million BTC were held by cryptocurrency exchanges, the lowest amount since March 2018.

This comes along with the launch of US Spot Bitcoin ETFs in January 2024. Since then, ~161,000 BTC flowed out of exchanges, amounting to nearly US$10 billion.

Weekly Performance

BTC and Ether (ETH) fell by -2.2% and -4.9% respectively in the past seven days. The price action for most other selected top market cap tokens was also negative. However, Bitcoin Cash (BCH) outperformed, which could be driven by its halving event.

Note: Rectangle size represents market cap

All of the selected key categories were down in terms of market capitalisation changes in the past seven days, with the meme coin and NFT categories leading the drop.

News Highlights

- Crypto.com launched a cryptocurrency payment solution at Adelaide Oval, a sports ground in Adelaide, Australia. Sports fans and concert-goers at the stadium can now pay via Crypto.com Pay to purchase food and drinks. This integration marks a world-first at this scale.

- PayPal enables cross-border money transfers with USD converted from PYUSD, the company’s stablecoin. This service is available to US users, and transfers can be sent to approximately 160 countries globally with no transaction fees.

- BlackRock updated its Spot Bitcoin ETF prospectus on 5 April to include five Wall Street firms as new authorised participants. This allows them to create and redeem shares of the ETF. These firms include ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs and UBS Securities.

- Monochrome Asset Management, an Australian investment management firm, unveiled plans for first Australian Spot Bitcoin ETF with Cboe Australia as its listing exchange. It is pending necessary approvals from market operators and regulatory bodies, and expects a decision before mid 2024.

- Ethena Labs’ USDe reached a $2 billion supply, becoming the fifth largest stablecoin by market cap. USDe, launched in February 2024, is a ‘synthetic dollar’ that aims to maintain the peg to 1 US Dollar by adopting derivative hedging. It was originally backed by ETH and added BTC as collateral last week.

- Ripple (XRP) announced plans to launch a US Dollar stablecoin on the XRP Ledger and Ethereum blockchain. The stablecoin aims to compete with USDT and USDC.

- Japan’s Sony Bank is experimenting with issuing its own stablecoin pegged to fiat currencies, like the Japanese yen for example. The trial will be on the Polygon blockchain with Belgium-based blockchain company SettleMint. The stablecoin can be used as payment for game and sports IPs owned by Sony Group.

- US Bank for International Settlements and seven central banks explore asset tokenisation of cross-border payments. The initiative, named ‘Project Agora’, explores the integration of tokenised commercial bank deposits with tokenised wholesale central bank money within a public-private financial platform. This aims to provide new solutions to the monetary system using smart contracts.

- China has launched a new public blockchain infrastructure platform in collaboration with Conflux Network. This initiative aims to support cross-border applications along the Belt and Road Initiative.

Recent Research Reports

|  |  |

|---|---|---|

| Crypto.com Visa Card Consumer Spending Insights 2023 | Decentralised Compute for AI Development | Bitcoin Ordinals Development and Introduction to Runes |

| Crypto.com Visa Card Consumer Spending Insights 2023 |

|---|---|

| Decentralised Compute for AI Development |

| Bitcoin Ordinals Development and Introduction to Runes |

- Crypto.com Visa Card Consumer Spending Insights 2023: A full breakdown of what our community across the globe likes to spend on in 2023.

- Decentralised Compute for AI Development: This report explores the subsectors of the decentralised compute networks and their representatives, and how they contribute to the development of AI.

- Bitcoin Ordinals Development and Introduction to Runes: We explore Bitcoin Ordinals‘ development, from BRC-20 to Runes, as well as the significance and controversies surrounding them.

Recent University Articles

|  |  |

|---|---|---|

| What Is the Aave Protocol? | What Is Coq Inu and How to Buy COQ | What Is BOOK OF MEME and How to Buy BOME |

| What Is the Aave Protocol? |

|---|---|

| What Is Coq Inu and How to Buy COQ |

| What Is BOOK OF MEME and How to Buy BOME |

- What Is the Aave Protocol?: Aave allows users to borrow and lend crypto with overcollateralised loans. Here’s how it works and how you can earn interest with Aave.

- What Is Coq Inu and How to Buy COQ: Coq Inu opened up a new category in the world of meme coins with a play on the French word for rooster. Here’s what else to know about this trending token.

- What Is BOOK OF MEME and How to Buy BOME: BOME burst onto the meme coin scene in March 2024 and has quickly captured the crypto space’s attention. Here’s an introduction to the project and the potential of its coin.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.