Live BitcoinHalving Countdown

BitcoinHalving Countdown

What Is a Bitcoin Halving?

The 2024 Bitcoin halving is a pre-programmed reduction in the rewards that miners receive for validating transactions on the Bitcoin network. This process occurs after every 210,000 blocks are mined, which happens approximately every four years.

This is a deflationary measure that ensures that the total supply of Bitcoin is capped at 21 million coins. With each halving event, the reward for mining new blocks is cut in half, leading to a gradual reduction in the rate at which new bitcoins are created.

From a macroeconomic perspective, the concept of reducing the rate of new supply while demand remains constant or increases often leads to a bullish sentiment amongst market participants. This anticipated scarcity has historically been associated with upward price movements in the run-up to a halving event, making it a significant milestone for the Bitcoin ecosystem.

What Will Happen During the 2024 Bitcoin Halving?

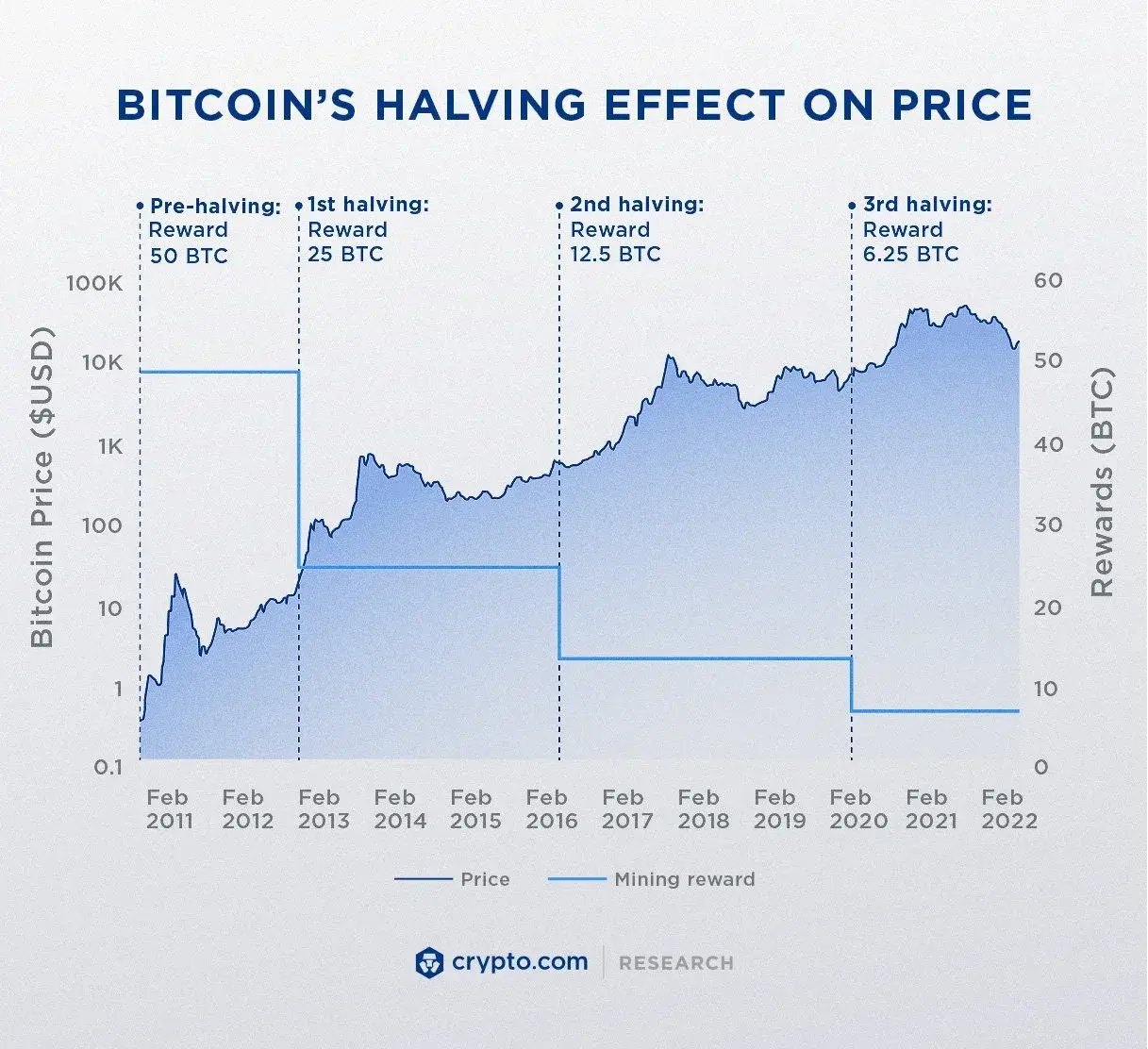

The block reward for Bitcoin will decrease to 3.125 BTC during the upcoming halving, which is projected to take place in April 2024. For reference, in 2012, the reward was cut from 50 BTC to 25 BTC, followed by halvings in 2016 and 2020.

By analyzing previous cycles, we can gain insights into impacts on price, market dynamics, and supply. In 2012, bitcoin saw a price surge following its halving. In 2016 and 2020, consolidation periods gave way to sustained rallies to new highs. So many traders assume that the same will happen following the 2024 halving event.

The Impact of Bitcoin Halvings on the Cryptocurrency Market

The impact of Bitcoin halving reverberates across the entire cryptocurrency market, influencing not only the price of Bitcoin itself, but also the dynamics of other digital assets.

The narrative of scarcity and the finite supply of Bitcoin are amplified during these events, fueling speculation and market dynamics. This heightened attention often results in increased media coverage and public interest in cryptocurrencies, potentially attracting new participants to the market.

How Past Bitcoin Halving Events Impacted Bitcoin Price

To gain insight into the potential implications of the 2024 Bitcoin halving event, let’s take a closer look at the historical performance of Bitcoin following previous halving events.

The first halving occurred in November 2012, followed by subsequent events in July 2016 and May 2020. Each of these milestones was accompanied by distinct price movements and market dynamics that offer valuable lessons for anticipating the future.

The first Bitcoin halving

In the lead up to the 2012 halving, Bitcoin’s price experienced a gradual uptrend, followed by a significant surge in the months that followed.

The 2016 halving

Similarly, the 2016 halving was preceded by a period of price consolidation, ultimately giving way to a sustained bull run that propelled Bitcoin to new all-time highs (ATHs).

The 2020 halving

The most recent halving in 2020 witnessed a similar pattern, with the price of Bitcoin surging to unprecedented levels in the subsequent months.

Counting Down to the 2024 Bitcoin Halving

As the countdown approaches zero in April 2024 and the halving event is officially triggered, the market is likely to witness heightened activity and volatility as participants react to the unfolding developments. This period of heightened attention and speculation can present both opportunities and challenges for traders seeking to capitalise on the anticipated market movements.

Predictions for the 2024 Bitcoin halving

Looking ahead to the 2024 Bitcoin halving, market analysts and industry experts have put forth a wide range of predictions and projections regarding the potential impact on Bitcoin’s price and market dynamics. While no one can predict the outcome of future events, below are a few factors worth consideration when assessing the implications of the upcoming halving event.

Will the trend continue?

One plausible scenario is a continuation of the historical trend, wherein Bitcoin experiences a period of accumulation and consolidation leading up to the halving event, followed by a surge in price as the reduced supply takes effect. This is supported by the principles of supply and demand, as well as the psychological factors that drive market sentiment during halving events.

On the other hand, it might also be possible that a run-up in price before the halving could affect prices in the event, potentially resulting in subdued price action afterwards.

Strategies for Navigating the 2024 Bitcoin Halving

In light of the potential impact on the cryptocurrency market by the 2024 Bitcoin halving event, many traders are considering which strategic approaches to take.

Diversification

One such strategy involves prudent risk management and portfolio diversification to help mitigate the inherent volatility and uncertainty associated with halving events.

Dollar Cost Averaging (DCA)

Dollar Cost Averaging (DCA) is another strategy that entails regularly investing a fixed amount in an asset (like Bitcoin) over time, irrespective of its price fluctuations. In the case of Bitcoin, this approach allows traders to accumulate Bitcoin at an average cost, potentially reducing the impact of short-term market volatility and providing exposure to the long-term potential of the cryptocurrency.

Strategic trading

Engaging in thorough research and staying informed about market developments and macroeconomic trends is crucial for making well-informed trading decisions. By understanding the historical context of previous halving events and the broader dynamics of the market, traders can potentially position themselves to capitalise on opportunities and navigate the potential challenges arising from the 2024 halving event.

What Happens After a Bitcoin Halving?

After the 2024 Bitcoin halving, several events could occur:

Reduction in Supply:

The halving results in a decrease in the number of new bitcoins entering circulation. Miners receive reduced rewards for validating transactions on the Bitcoin network, leading to a lower inflation rate for Bitcoin.

Potential Price Surges:

Historical data suggests that Bitcoin prices have tended to surge in the months following a halving event. The reduction in supply acts as a catalyst, sparking bullish sentiment and speculative activity among traders and investors.

Scarcity Narrative:

Bitcoin's halving reinforces the narrative of its scarcity and finite supply. This aspect of Bitcoin's design is often highlighted during halving events, which can increase market interest and demand, potentially leading to price appreciation.

Accumulation and Consolidation:

Prior to the halving, there has been a historical trend of accumulation and consolidation in the Bitcoin market. This period of stability is often followed by a surge in price as the reduced supply takes effect.

Conclusion

The 2024 Bitcoin halving event represents a pivotal moment for the cryptocurrency market as a whole, with potentially far-reaching implications for traders and miners alike. By understanding the mechanics of Bitcoin halving, analysing its historical impact, and formulating strategic approaches, market participants can position themselves to navigate and potentially capitalise on the opportunities presented by the next Bitcoin halving event.

As the countdown to the 2024 halving event continues, it is essential for market participants to maintain a balanced perspective and exercise prudence in their decision-making. The interplay of market dynamics, regulatory developments, and macroeconomic trends underscores the complexity of the cryptocurrency landscape, requiring a holistic approach to trading and risk management.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Buy Bitcoin with the

Crypto.com App

Buy Bitcoin, Ethereum, and 250+ cryptocurrencies