Key Takeaways:

- Bitcoins are created through a process called ‘mining’, where miners are required to solve a complex mathematical puzzle; in return, they are rewarded with new bitcoins.

- In this system, called Proof of Work (PoW), anyone with a computer and the proper setup can become a miner to validate and record transactions with other miners.

- Mining farms are industrial-scale warehouses packed with mining equipment for the sole purpose of mining cryptocurrency.

- Every 210,000 blocks, or roughly every four years, the Bitcoin mining reward halves.

- Since mining rewards gradually decrease for Bitcoin, there is another type of incentive for miners who verify transactions: network fees.

- As Bitcoin gets harder to mine, and as mining rewards halve, many might find it less alluring to try mining bitcoins.

What Is Bitcoin Mining?

Bitcoins are created through a process called ‘mining’, where miners are required to solve a complex mathematical puzzle before they can add new transactions to the blockchain. In return, they are rewarded with new bitcoins.

In this system, called Proof of Work (PoW), anyone with a computer and the proper setup can become a miner to validate and record transactions with other miners.

Block Time and Difficulty Adjustments

It is important for the system to keep a relatively constant pace regardless of how many miners are active, but it is difficult to predict how many miners will join.

Bitcoin uses a mechanism called ‘difficulty adjustment’ to keep the mining speed constant, at approximately 10 minutes per block. The ‘difficulty’ is adjusted every two weeks, taking into consideration the existing hash power (amount of miners) in the past. If the hash power is insufficient (i.e., the average block time is longer than 10 minutes), the difficulty is lowered. Conversely, if the hash power is too high (i.e., the average block time is faster than 10 minutes), the difficulty is increased.

Confused by block time and halving rates? Here’s an intro to Bitcoin halving.

How Are Difficulty Adjustments Determined?

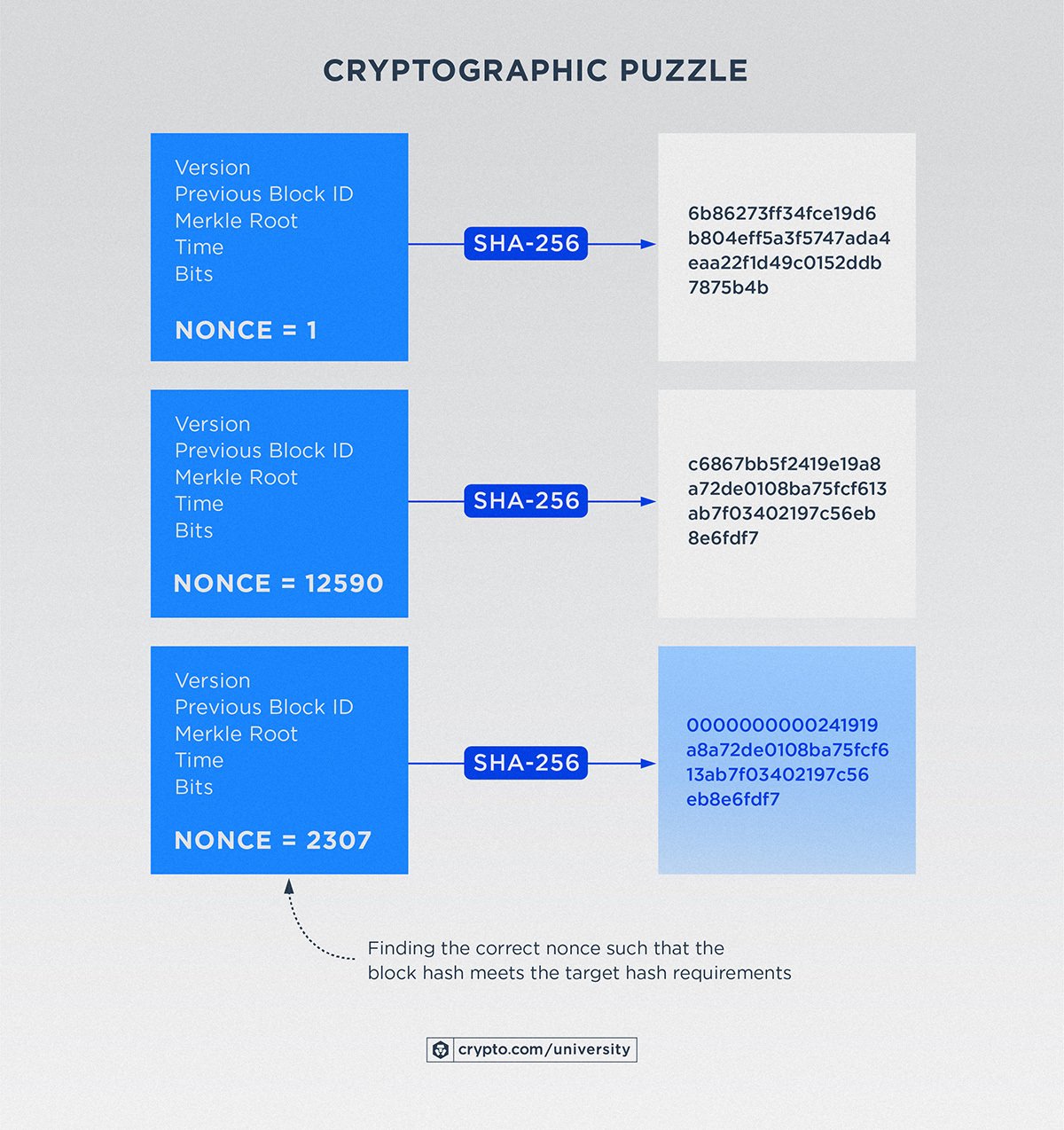

Bitcoin’s protocol requires miners to compete with each other to solve a ‘cryptographic puzzle’ (called Proof of Work), and the winner proposes a new block for the blockchain.

The cryptographic puzzle is solved by adjusting the nonce (a 32-bit arbitrary random number) so that the block hash is smaller than the target hash (a value that is smaller than 256 bits).

Miners need to find a nonce so that the hash of the block is less than or equal to the target hash specified by the network. If the hash is below the target, then the miner wins and gets the mining rewards. If not, the miner changes the nonce and tries again. The more hash power in the network, the smaller the target hash. A smaller target hash means that it’s harder for miners to find the correct nonce to create a block hash that is smaller than the target hash.

For instance, imagine the computer randomly picking a number between 1 and 100. The probability of finding a number below 10 is 10%, but the probability of finding a number below fifty is 50%. This is how the Bitcoin network performs difficulty adjustments.

What Are Hashrates in Bitcoin Mining?

From the previous section, we see why hash power is important and how it is linked to block time and difficulty adjustment. Hash power is measured by the hashrate.

Hashrate

The hashrate is a measure of the number of hash operations done in a given amount of time. This varies depending on the hardware involved.

For example, if a miner has a device that generates a hashrate of 30 MHz, then there are 30 million hashes per second (a hash is one conversion from one state to another — or, to simplify, one calculation). So a Graphics Processing Unit (GPU) that yields a hashrate of 30MHz makes 30 million calculations per second.

Hashrate calculation

The higher the hashrate, the more likely a miner will solve the block and gain a block reward. The probability of a miner solving the block can be roughly estimated by the following formula:

P = X / Y

Where:

P = the probability of solving a block

X = the miner’s hashrate

Y = the total hashrate of the network, which is the total hashrate of all miners currently mining

Mining farms

Mining farms are industrial-scale warehouses packed with mining equipment for the sole purpose of mining cryptocurrency. With thousands of GPUs and Application-Specific Integrated Circuits (ASICs), the overall hashing power is far greater than that of just one solitary piece of mining hardware. This is designed to make it more likely that a block will be solved and a reward earned.

How Are Mining Rewards for Bitcoin Calculated?

Mining rewards are compensation (in the form of newly created bitcoins) generated by the system to pay for the work done by miners, who compete with each other in the network to solve the cryptographic puzzle required for mining a new block in order to receive the reward. Hence, the greater the hashrate, the higher the chance to receive the mining reward, which, for Bitcoin, is currently 6.25 BTC per block.

To improve the return on investment (ROI), mining companies and individuals often need to spend quite a bit up front on hardware and electricity to increase the chance of successful mining. With the drastic increase in the total hashrate of the Bitcoin network, it becomes almost impossible for an individual alone to mine bitcoin due to limited resources.

Mining pools, however, allow individuals to pool resources together and contribute to their outsourced mining. In this way, mining pools gain more resources to compete against each other, and individuals share the rewards in proportion to their hashrate. This mitigates the low probabilities and high upfront costs they may face when mining alone.

Mining is not the only way to earn Bitcoin. Learn about Bitcoin trading here.

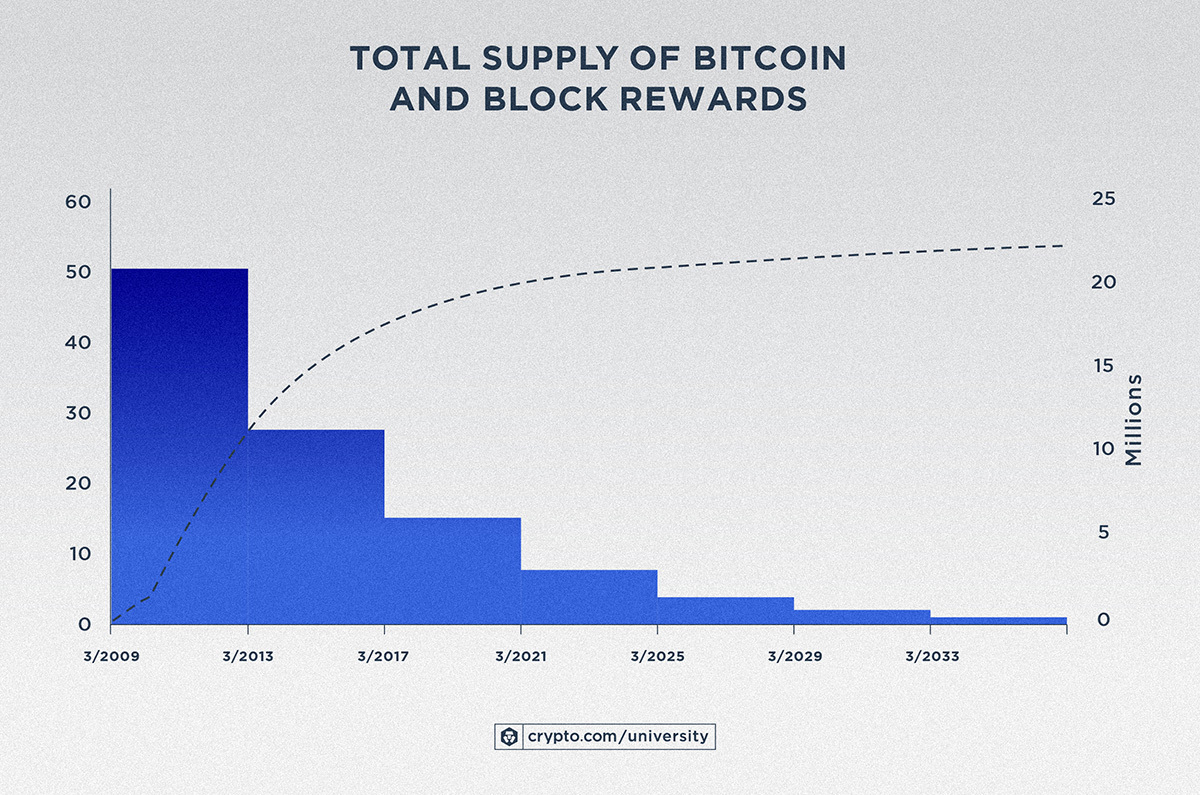

Bitcoin Halving: Half the Mining Rewards

Every 210,000 blocks, or roughly every four years, the Bitcoin mining reward halves. In the beginning, the Bitcoin block reward was 50 BTC. In 2012, it was halved to 25 BTC, and halved again in 2016 to 12.5 BTC. In 2020, the block reward halved again, to the current 6.25 BTC, and will continue to halve until all 21 million BTC are mined.

Read our in-depth guide What Is Bitcoin Halving and How Does It Affect BTC Price?

Bitcoin’s Token Supply

Currently, at the time of writing, there are more than 19 million bitcoins mined (of the total token supply of 21 million).

The total supply and actual supply of bitcoins vary slightly due to loss of private keys or hardware damage. Additionally, some bitcoins are permanently lost and cannot be recovered, making the actual supply smaller than the theoretical value. The inventor of Bitcoin, Satoshi Nakamoto, also has a considerable amount of bitcoins left untouched after mining it years ago.

The next Bitcoin halving is expected to occur in 2024, and some have predicted that all bitcoins will be mined a few years after 2100.

Another Way for Bitcoin Miners to Get Paid: Transaction Fees

Since mining rewards gradually decrease for Bitcoin and other coins that adopt the PoW mechanism, there is another type of incentive for miners to verify transactions: network fees. For coins that work under the PoW consensus, users need to pay a network fee for every transaction. This transaction fee may vary in different network traffic conditions and for different coins. The transaction fee is usually calculated in satoshi (the smallest unit of bitcoin) per byte.

Transaction fees are the incentives for miners to verify user transactions. Note that it is possible to pay no or low transaction fees, but that significantly lowers the chance for the transaction to be included in the next block.

Final Words — Is Bitcoin Mining Still Worth It?

As Bitcoin gets harder to mine, and as mining rewards halve, many might find it less alluring to try mining bitcoins. In addition, newcomers have to compete with professional-level mining farms and invest in expensive mining rigs in order to be competitive. Other options to receive crypto rewards include lockup, Crypto.com Earn, and holding cryptocurrency.

Market participants can download the Crypto.com App to buy Bitcoin or other cryptocurrencies, starting with as little as US$1.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any digital assets. Returns on the buying and selling of digital assets may be subject to tax, including capital gains tax and/or income tax, in your jurisdiction or the jurisdictions in which you are a resident for tax purposes. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of digital assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a digital asset, it’s essential for you to do your own research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.